Taking payments is a crucial part of any spa business. In this blog, we’ll share insights into what integrated payment processing is, its importance, and additional perks when your two systems are working together.

The payment services you sign up for to accept credit cards in your spa is called a payment processing service. You might have obtained your processing services through your local bank as part of setting up your business account, purchased the credit card reader hardware as part of your front desk POS, or opted for mobile reader hardware from a provider like Square.

Now, when we say “integration” of a payment processing service, we’re talking about connecting that credit card processing service to your spa management software. The spa software tracks your clients and their purchases. When it comes time for a client to pay for services with a credit card, many front desk personnel need to juggle these two systems.

The spa software provides the total amount due and, if not integrated with your spa software, that amount needs to be manually entered into the payment system.

Perhaps that’s into a separate computer or a payment terminal (swiper/ scanner) that is physically connected to the same computer but uses separate software. This means you’re switching systems – taking the amount owed from one application and then manually entering it into the payment system.

Hurried receptionists trying to check the client out, maintain some level of cheerful small talk, and rebook or up-sell (ignoring the ringing phone) may make mistakes in entering the amount due that no one notices until a day/week later, causing you to be out of money earned.

Aside from making a mistake, operating this way can also have other implications. Client checkout is when you should focus on asking the client about their experience and upsell opportunities like re-booking times or selling products.

This isn’t the time to be copy data from one system to another, double checking the amounts, and asking the client to authorize the purchase on another machine.

You would save time for the client and remove the possibility of human error if we ran through this scenario with an integrated payment system. In the spa software, the invoice/ticket shows the amount due and when the client presents a credit card, the card gets swiped on a processing terminal connected to the same PC and the ticket is immediately closed after a successful swipe.

Reports in the spa management software are consolidated and correct – no need to reconcile bank statements with other reports to ensure you’ve been paid for every service.

The payment system can also suggest tip amounts to the client, adding to your services revenue without having to ask.

Things to keep in mind when choosing the right payment processing services:

Seek a Great Rate

There is money to be saved in every swipe! The variation in rates can sound really small. You might be wondering, what’s the difference between 2% and 3%? It seems like it isn’t worth the trouble to switch and save a few percentage points or avoid “per transaction” fees. But even for a small volume spa, 1% could mean an additional $1,000 or more! It adds up, and it’s all money out of your pocket.

Your Right to Choose

Just because you started the service with your bank or your POS provider doesn’t mean you can’t switch. In fact, there may be some very good reasons to do exactly that and, while preserving profit is always paramount, there are other reasons like state-of-the-art signature capture hardware or merchant portals that let you monitor your activity and access to funds. This is crucial if you don’t want to wait days to get paid.

Integrating your business systems isn’t just about simplifying reports for your accountant or spending more time at checkout focused on people instead of process. Having these two critical business functions side by side makes more possible for your spa. Namely bringing new, profitable offerings to your spa because you can securely store a credit card number (or token) in your spa software.

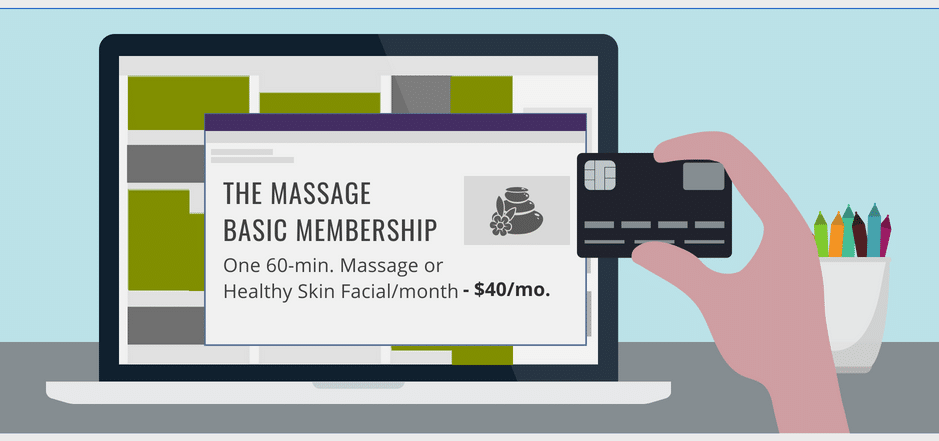

One of the most popular is the concept of “memberships.” This might not be right for every spa business, but the idea here is that you can offer discounts on products or services for your best customers if they pay every month to get access to a discount on these recurring services (similar to a subscription). For example, a customer membership might include “one 60-minute massage a month” for $40.

This presents your clients with an opportunity to get a discount on services they know they like but, in your favor, might not have otherwise obtained that frequently – whether it’s a massage or facial. It is also a great client retention tool that can create passive recurring revenue, which can provide crucial cash flow during seasonal downturns.

Beside memberships, integrated payment systems can enable online deposits which can be a lifesaver if your clients book appointments online. Having a deposit associated with it will slash your “no show” rates and protect you in cases where people book your time but don’t make their appointment.

It’s easy to see that integrating your spa business software and processing services can save you time, make you money, and allow you to bring exciting new products to your customers, which can strengthen those relationships and secure your revenue streams with new, profitable services.

Contact us and we will get you started on your journey to offering customers new processing services and making more money!